Linda Heath, president of Financial Holographix 1, emphasizes the importance of thinking “net” cash flow. The lender believes they are performing a ‘Global’ analysis by obtaining and analyzing all of the people and businesses involved in the loan request, but it is not truly Global until all of these cash flows are combined into a single GCF. It may seem obvious that the above isn’t even a GCF analysis by definition, but this mistake happens. Obtaining business and personal financials, but not combining them into a single cash flow When performing a Global Cash Flow (GCF) analysis, there are several mistakes that financial institutions make that could be the difference between approving and denying a loan request:ġ. Global Cash Flow analysis is used by financial institutions to assess the combined cash flow of a group of people and/or entities to get a global picture of their ability to service the proposed debt. Our people.ĭiscover what life is like with an award-winning culture and a team that Makes BIG Things Happen. Join us on the journey to create a diverse and inclusive culture for our most valuable assets. Making an impact in our industry and beyond With experience across hundreds of CECL filers, our team takes the stress out of CECL transitions. Our AML experts provide outsourced assistance with alerts, cases, lookbacks, and more.

#Cash flow definition software

Gain actionable insights through data visualization software Make better strategic decisions through dynamic ALM modeling Identify risk in portfolios, concentrations, and borrower relationships Simplify loan management to boost income, lower risk.Īutomate the entire life of the loan to identify and monitor risk Grow SMB lending profitably with a platform that scales Increase revenue and support consumers with multiple loan types Trusted partnerships for integrating Abrigo into your ecosystemĪssess and act on creditworthy borrowers quickly Securities and Exchange Commission at your institution and customers with fraud scenarios Telephone/Internet/Cable (landline and mobile)Īdapted from "Get the Facts: The SEC's Roadmap to Saving and Investing," available on the website of the U.S. Investments (including contributions to a company retirement savings account or an IRA) Other Income (such as child support or federal benefits) Monthly Income and Expenses Sample Worksheet Income:

#Cash flow definition professional

A financial professional may be able to help you with these matters. Perhaps a debt refinancing or consolidation could reduce your monthly payments. Maybe some of your discretionary expenses are luxuries that you could give up. If this is not the case, look for expenses you could eliminate or reduce.

To invest, your net income must exceed your expenses-with some to spare.

Similarly, if the result is a positive cash flow, but your spending nearly equals your earnings, it might be too soon to start investing right now. If the result is a negative cash flow, that is, if you spend more than you earn, you'll need to look for ways to cut back on your expenses.

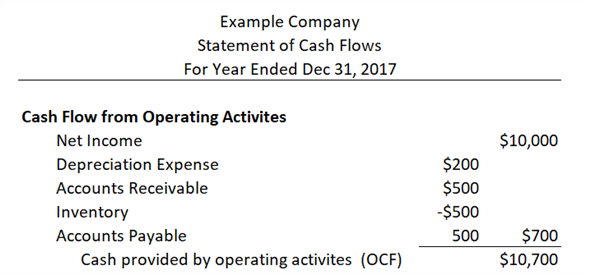

Subtract your monthly expense figure from your monthly net income to determine your leftover cash supply. Average your actual expenses over a three month period to come up with a reliable monthly estimate for your total expenses. Don't forget money that you spend on items that are "discretionary," rather than necessary-for example, cable television subscriptions, gym fees, clothing, gifts, and the like. Also include money for groceries, utilities, transportation and insurance. These include your rent or mortgage, car lease or loan, personal loan, credit card and child support or alimony payments. Then calculate your average monthly expenses. If you already own some investments, you may be receiving dividend or interest payments factor that amount into income, too. This includes your salary and other steady and reliable sources of income, such as income from a second job, child support or alimony that you receive, or social security. Calculating your monthly cash flow will help you evaluate your present financial status, so you know where you stand financially as you prepare to invest.īegin by looking at your monthly net income-the money you take home every month after taxes.

0 kommentar(er)

0 kommentar(er)